How to calculate Contribution Margin 1 (CM1)?

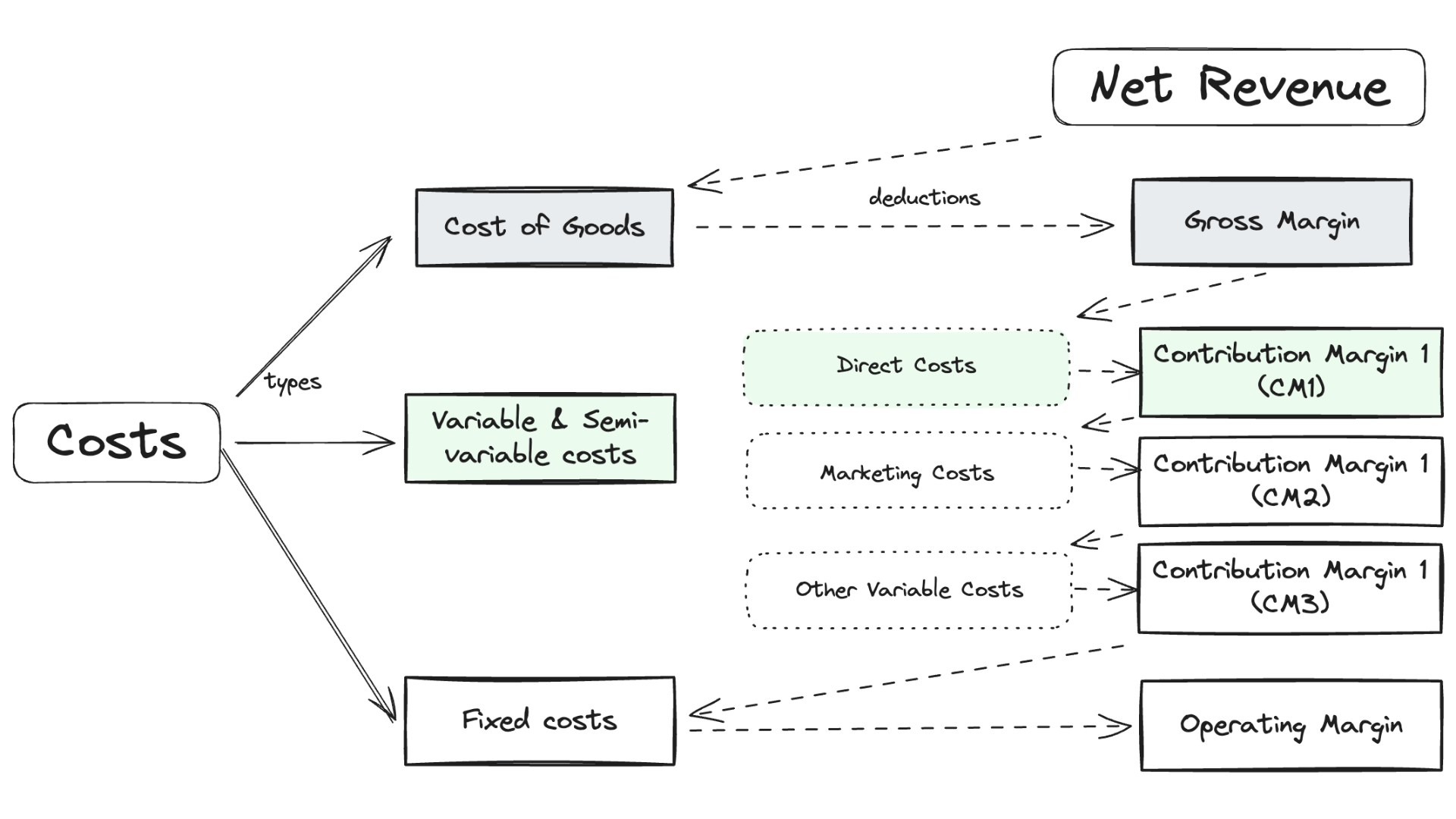

Contribution Margin 1 (CM1) is the profit per unit achieved after subtracting direct materials, direct labor, and direct shipping or handling costs.

Essentially, you deduct direct labor and shipping/handling costs from Gross Margin.

CM1 is represented both as an absolute figure and as a percentage (CM1%) of the sales revenue.

Example:

An online retail company in India sells an electronic item for ₹5,000 per unit.

The direct material cost is ₹2,000 per unit, direct labor cost is ₹400, and direct shipping cost is ₹100 per unit.

The CM1 per unit and CM1% are computed as follows:

CM1 = Net Revenue per Unit - (Direct Material Cost + Direct Labor Cost + Direct Shipping Cost)

= ₹5,000 - (₹2,000 + ₹400 + ₹100) = ₹2,500

CM1% = (CM1 / Net Revenue per Unit) × 100 = (₹2,500 / ₹5,000) × 100 = 50%

Significance of CM1:

CM1 and CM1% are key indicators of the profitability of each unit sold by a business.

If the management is satisfied with Gross Margin % (i.e. it is comparable to that for other businesses in the same category), but not satisfied with the CM1%, variable costs such as direct labor costs and shipping costs need to be looked into.