How to calculate Contribution Margin 3 (CM3)?

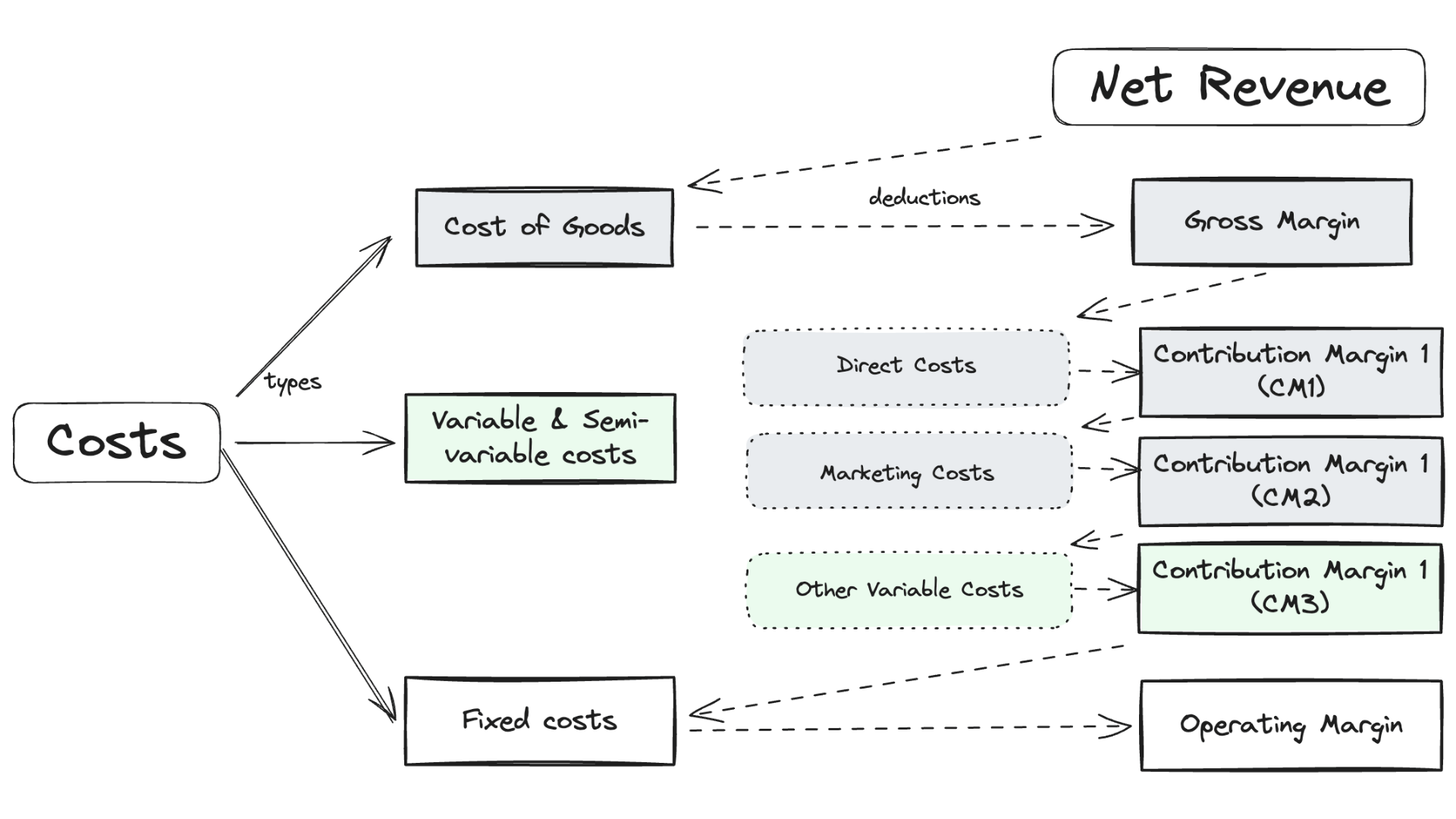

Contribution Margin 3 (CM3) per unit is the profit remaining after all variable costs have been subtracted from the gross revenue.

These variable costs include direct production costs, marketing expenses, and any additional variable operational costs.

CM3% is the percentage of gross revenue that remains after these variable costs are accounted for, providing a clear picture of how much each unit sold contributes to covering fixed costs and generating profit.

Example:

An online service provider offers a digital subscription package for ₹8,000 per unit.

The direct production cost (including server and bandwidth costs) is ₹2,000, marketing expenses amount to ₹1,200, and other variable operational costs (like transaction fees and customer support) are ₹800 per unit.

The CM3 and CM3% for each subscription sold are:

CM3 = Gross Revenue per Unit - (Direct Production Costs + Marketing Expenses + Other Variable Operational Costs)

= ₹8,000 - (₹2,000 + ₹1,200 + ₹800) = ₹4,000.

CM3% = (CM3 / Gross Revenue per Unit) × 100 = (₹4,000 / ₹8,000) × 100 = 50%.

Significance:

At a very broad level, Gross Margin% for a business tells us how much of their revenue is going into just producing the good or services.

And, Contribution Margin % tell us how much of their revenue goes into all of their variable costs, i.e. how much of the revenue remains to cover its fixed costs.

Additionally, breaking down CM% into different levels i.e. CM1%, CM2%, and CM3%, gives us more granular insights into which variable cost needs to be optimised.