How to calculate Operating Margin?

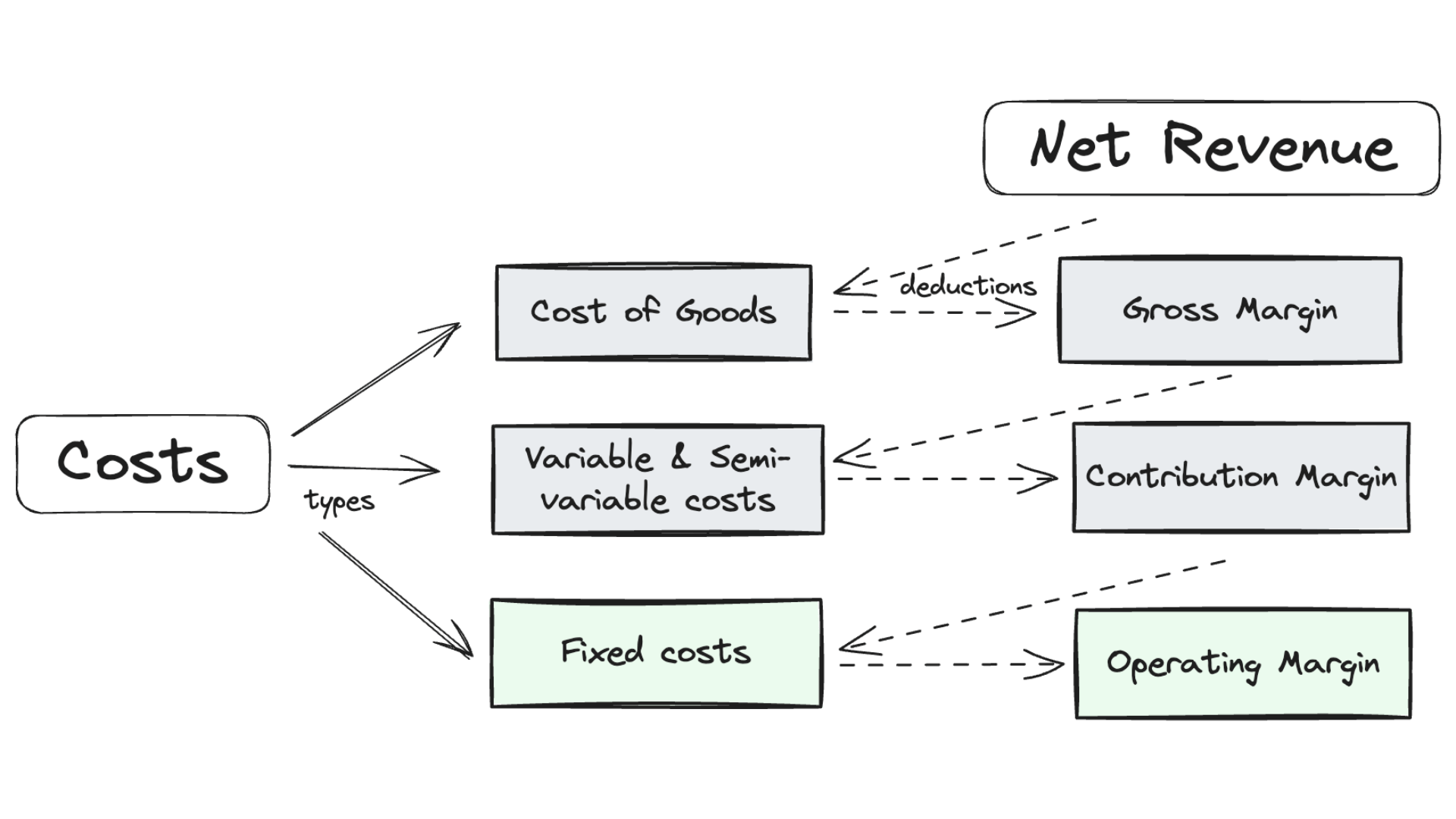

Operating Margin is a financial metric that measures the proportion of a company's revenue that remains after subtracting all operating expenses, including both variable and fixed costs, but excluding interest and taxes. It's expressed as a percentage of revenue.

Example:

An Indian IT service company reports a revenue of ₹50 crore in a fiscal year.

Its variable costs, including direct labor and technology expenses, amount to ₹15 crore, and its fixed costs, like office rent and administrative salaries, total ₹10 crore.

The Operating Margin is calculated as:

Operating Margin = [(Revenue - Variable Costs - Fixed Costs) / Revenue] × 100

Operating Margin = [(₹50 crore - ₹15 crore - ₹10 crore) / ₹50 crore] × 100 = 50%.

Significance:

Operating Margin is a key indicator of a company's operational efficiency and its ability to generate profit from its core business activities.

It reflects how effectively the company is managing its costs and utilizing its resources. A higher Operating Margin implies that a larger percentage of revenue is being converted into profit, indicating better operational efficiency.

This metric is particularly important for stakeholders, including investors and management, as it provides insights into the company's financial health and its potential for long-term sustainability and growth.